by Barbara Kempen | Apr 27, 2022 | Affordable Health Insurance, Covered California

Many members enrolled in health insurance through the Covered California exchange accept premium assistance based on their income, age, zip code, and household size. If you are enrolled in health insurance through Covered CA, please make sure to do, at minimum, an...

by Barbara Kempen | Apr 8, 2022 | Affordable Health Insurance, Tax Credits

On April 6th, 2022, the Biden administration proposed a change to how the IRS calculates the affordability of health insurance for employees and their families. The affordability test is used to calculate if a household is eligible for premium assistance through...

by Barbara Kempen | Apr 6, 2022 | Affordable Health Insurance, Tax Credits, Tax Penalty

As many Americans are still preparing their taxes before the April 18th deadline, please make sure that you have your 1095 (federal) & 3895 (state) tax forms and provide them to your tax preparer as they are required to complete your taxes. In California, there is...

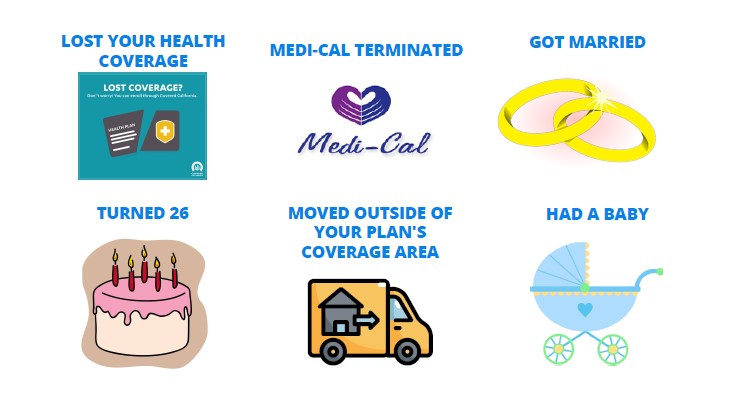

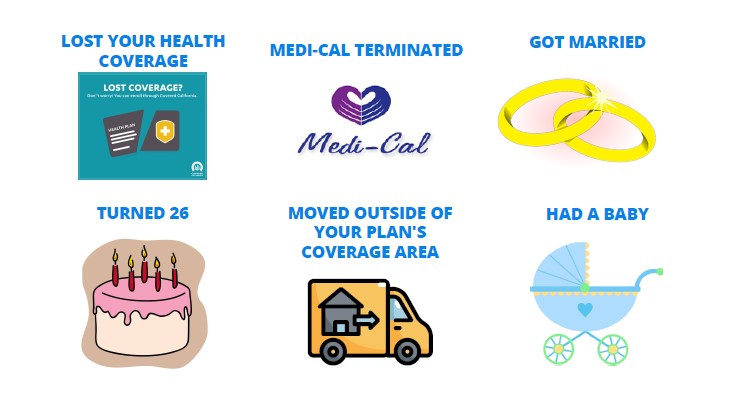

by Barbara Kempen | Mar 9, 2022 | Special Enrollment Period

Once the Special Enrollment Period started on February 1st, 2022, anyone looking to enroll in or change their health insurance must now have a qualifying life event to do so. A qualifying life event is a major life event that must occur within the last 60 days in...

by Barbara Kempen | Sep 22, 2021 | Affordable Health Insurance, Covered California

As the annual Open Enrollment Period approaches this fall, there are some major changes to be aware of for your health insurance renewal. In 2022, Covered California ( Covered CA) premium rates will have a modest weighted average premium increase of 1.8% across...