Federal Subsidy 2023

Will I as an Individual or my family be eligible for tax credits in 2023?

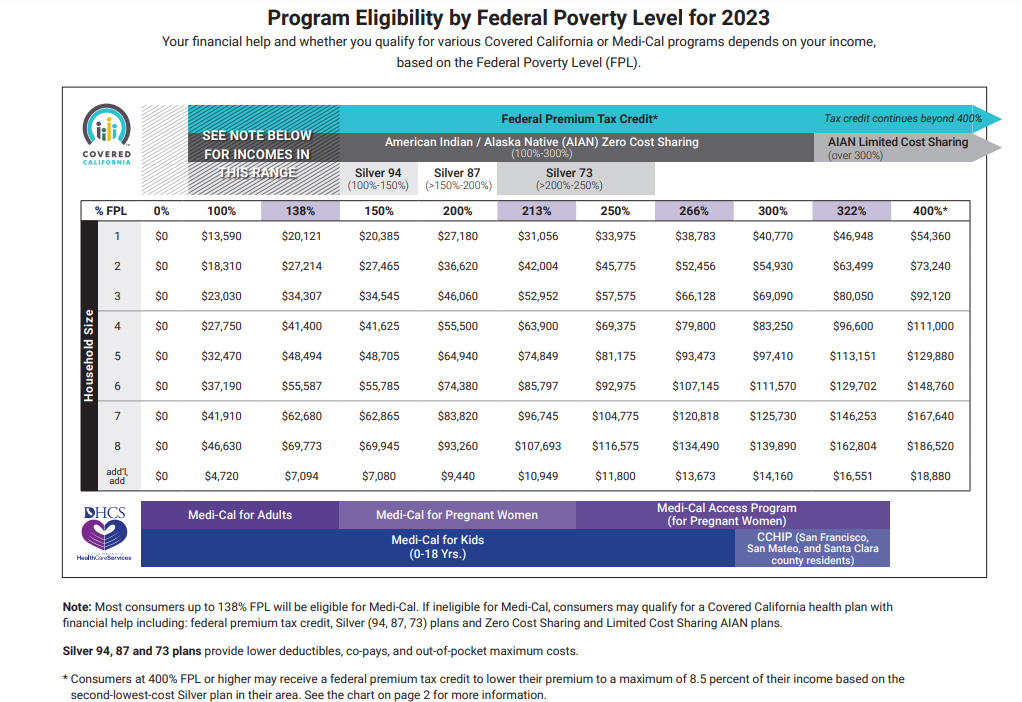

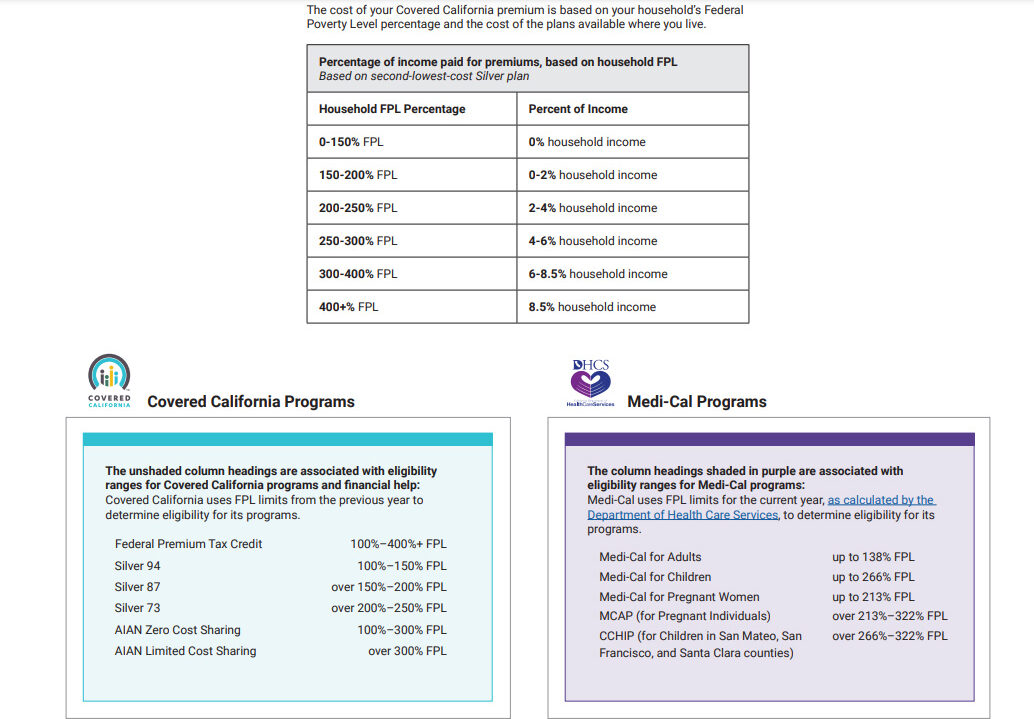

Depending on your income, your age, the size of your household, and where you live, many Americans might qualify for subsidies in the form of tax credits or direct governmental payments towards health insurance to pay for insurance premiums. Not only low-income families but also middle-income families, may qualify for premium assistance through Covered CA. The subsidy is based on the Modified Adjusted Gross Income based on your 1040 tax return of the previous tax year (Line 11 of your 1040 for the 2022 tax year) , and will be adjusted yearly accordingly to your tax return. Below is the 2023 Federal Poverty Guideline. If you earn under 600% of the FPL, you will most likely be eligible for a subsidy, which helps you pay part of your health insurance premium.

The Kaiser Family Foundation has created the Health Reform Subsidy Calculator, which easily shows if you will qualify for subsidies. Please use this important tool from the Kaiser Family Foundation to estimate your cost.

https://www.kff.org/

The subsidies are not available for employees who are eligible for health insurance from their employers; however, if your employer-sponsored coverage costs more than 9.61% of your household income, it fails the affordability test and you may be eligible for premium assistance through Covered CA. The affordability test only factors the cost of the employee towards the lowest cost plan available, it does not factor in the cost of household dependents.