The deductible for many individual, family, and group plans are considerably higher than years ago. The Silver 70 and Bronze 60 plans have medical deductibles of $ 4,000 or $ 6,300 respectively for an individual or double for a family ($8,000 for the Silver 70, $12,600 for the Bronze 60). These plans have an additional out-of-pocket maximum of $7,800 for an individual or $15,600 for a family. To offset the financial risk of having to pay the deductibles and out-of-pocket maximum annually, many families elect to buy supplemental insurance plans.

Most supplemental insurance plans are very affordable and the underwriting process is very easy. The supplemental insurance mostly pays a specific dollar amount if an accident or critical illness occurs.

The specific dollar amount can be used for paying the medical expenses the regular health insurance is not paying, such as deductible and out-of-pocket maximum, or can be used for all other purposes. For example, you can pay your bills such as a utility bill in the event you are critically ill.

- Accident Insurance

Individuals can insure themselves for just $25.73 per month and receive coverage of $ 25,000 for each accident that happens. Click here to review the National General Accident Fixed Benefit brochure.

- Critical Illness Insurance

Critical Illness Insurance pays a fixed dollar amount should a specific critical illness occur, such as invasive cancer, heart attack, stroke, Alzheimer’s or other critical illness. National General’s TrioMed plans cover between $5,000 to $10,000 in medical expenses and usually costs between $40-$50 per month for an individual.

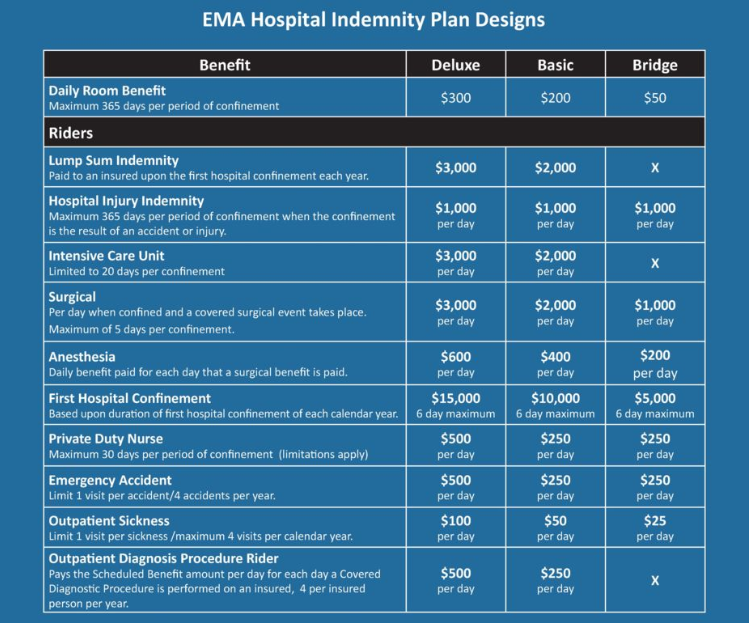

- Hospital Indemnity

EMA or the Emergency Management Alliance offers hospital indemnity plans to cover your hospital expenses. The premiums per month for a healthy 40-year-old start at $67 a month for their bridge plan option. These plans will pay $1,000 per day in the hospital, $0-$3,000 per day for intensive care unit or ICU, $1,000-$3,000 per day if surgery occurs, and more.