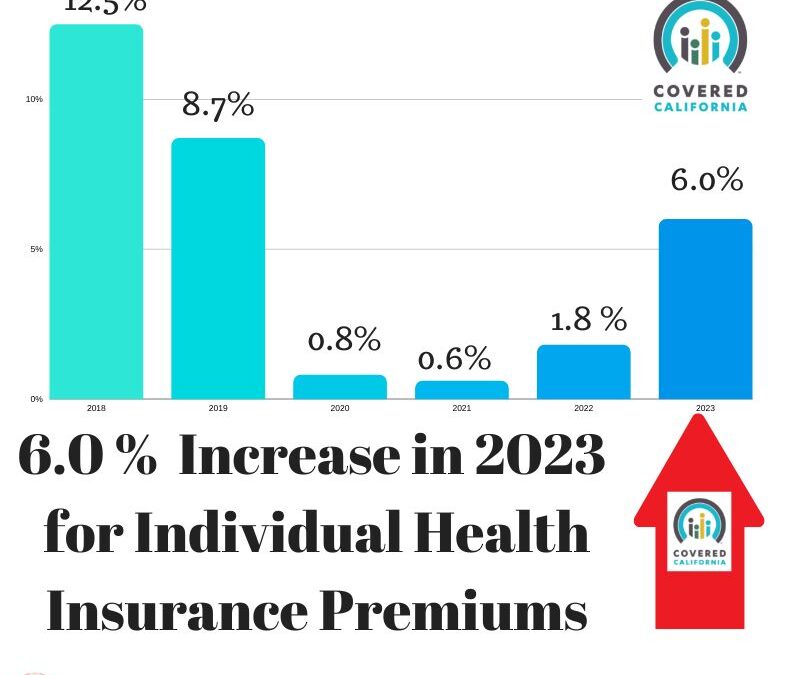

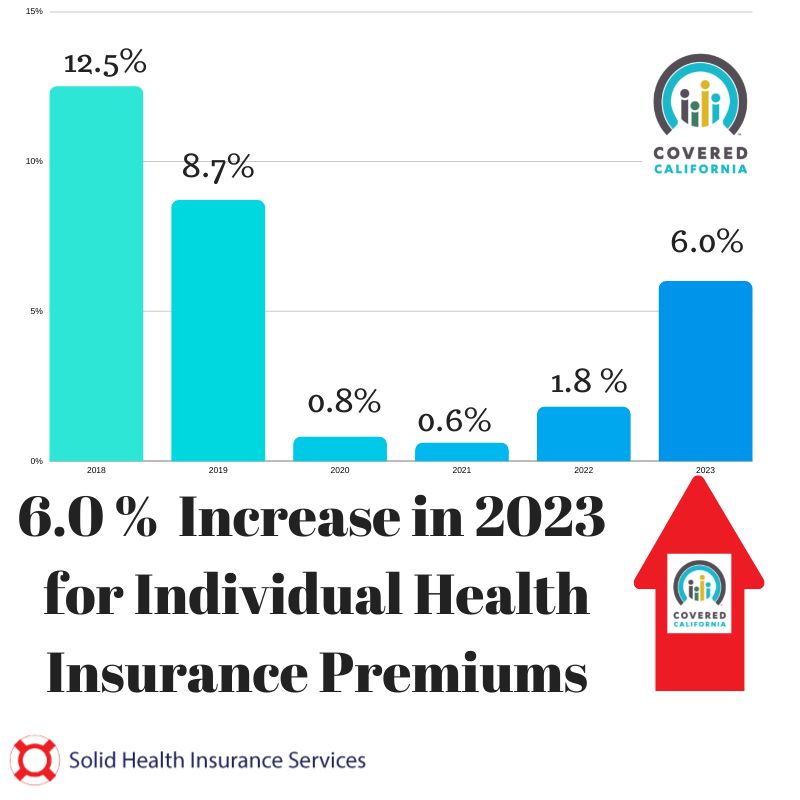

Although this is higher than last year’s 1.8% increase, it is lower than the national average rate increase of 10% (based on 13 states that have so far filed their rates). There is some good news such as the entrance of Aetna into El Dorado, Fresno, Kings, Madera, Placer, Sacramento & Yolo counties as well as the return of Anthem into San Diego county next year.

LA Care is seeing the smallest rate increase of only 2% while Oscar, again, is seeing the highest average increase of 13.2%. Blue Shiel expects a rate increase of 9.2% while Anthem is seeing a more reasonable 5.8% increase. Kaiser is also seeing a below-average rate increase of 4% next year. The regional rate increases will be available at renewal time which will be at the beginning of October. We will contact our clients once we have the regional rates available.

Please contact us, or visit our website at Solidhealthinsurance.com if you need to make changes to your income, address, or family status. Due to the still-going pandemic, Covered California is still allowing us to make changes to your 2022 health plans.

This week, Covered CA announced its preliminary plan and health care rate increase for the upcoming 2023 coverage year. The weighted average health care premium will have a six percent increase for the individual & family market.

Here is the full press release

“Covered California Announces 2023 Plan Rates: Lower Than National Average Amid Uncertain Future of American Rescue Plan Benefits

- California’s individual market will see a preliminary rate increase of 6 percent in 2023, due in part to the return of normal medical trends that existed prior to the COVID-19 pandemic and the uncertain future of the American Rescue Plan.

- Despite the uncertainty, the rate change is below the national average thanks to Covered California’s 1.7 million enrollees and the state’s healthy consumer pool, which remains among the best in the nation.

- Covered California also announced that a 13th carrier would join the marketplace, and an existing carrier would expand to become the second one to offer statewide coverage.

- All Californians will have two or more choice of carriers, 93 percent will be able to choose from three or more, and 81 percent will have four or more choices.

SACRAMENTO, Calif. — Covered California announced its plans and rates for the 2023 coverage year. The preliminary weighted average rate change is an increase of 6 percent, due in part to the return of a normal medical trend that existed prior to the COVID-19 pandemic, as well as the potential end of the increased and expanded financial help offered to eligible consumers through the American Rescue Plan, if Congress does not extend the law before it expires at the end of the year.

“Covered California’s competitive marketplace continues to hold the line on rates that are well below the national average, keeping coverage within reach and giving Californians new choices,” said Jessica Altman, executive director of Covered California. “However, without an extension of the expanded financial help provided by the American Rescue Plan, Californians will receive less financial help next year and see their monthly payments rise as a result.”

California’s Individual Market Rate Change for 2023

The preliminary average rate change of 6 percent is for Covered California enrollees, but most people in the individual market, which consists of approximately 2.3 million enrolled both on and off the exchange, have the same benefit designs and plan premiums as the 1.7 million purchasing health insurance through Covered California.

When averaged over the past four years, which includes record-low rate changes in 2020 and 2021, Covered California’s average rate change is just 2.3 percent.

Table 1: California’s Individual Market Rate Changes1

2020 Weighted Average: 0.8%

2021 Weighted Average: 0.5%

2022 Weighted Average: 1.8%

2023 Weighted Average: 6.0%

4-Year Average (2020-2023): 2.3%

The latest available data also shows that California’s rate change is below the national average of 10 percent among the 13 states, and the District of Columbia, that have preliminarily filed their rates. Covered California’s modest rate change is attributed to several factors:

- Covered California is an “active purchaser” and negotiates with carriers on behalf of consumers to deliver the best value. Many other states only conduct limited reviews of proposed rates or accept all rate submissions.

- Covered California’s strong enrollment, which stands at more than 1.7 million people.

- Covered California continues to be home to one of the healthiest consumer pools in the nation, with the most recent data showing that California had the second-lowest “state average plan liability risk score” in the nation in 2021. This marks the eighth straight year that California has been among the top five states in fostering healthy enrollment in the individual market.

- On the other end of the scale, after more than two years of lower-than-normal utilization rates, Covered California’s carriers are seeing medical trends return to pre-pandemic levels, accounting for an average of 4 percentage points.

The preliminary average rate change will vary by region and by an individual’s personal situation (see Table 2: Covered California Individual Market Rate Changes by Rating Region). The rates have been filed with California’s Department of Managed Health Care (DMHC) and are subject to its final review and public comment.

Californians both on- and off-exchange will also benefit from Covered California’s competitive marketplace and standard patient-centered benefit designs. Unsubsidized consumers could mitigate the rate change by switching to the lowest-cost plan in the same metal tier, saving an average of -5.8 percent on their gross premiums. However, it is important to note that regardless of their plan choice, the change in monthly costs subsidized consumers see will largely be determined by the future of the American Rescue Plan and, therefore, the amount of financial assistance available.

The Consequences of the American Rescue Plan Expiring

The American Rescue Plan ensures that everyone eligible will spend no more than 8.5 percent of their household income on their health plan premiums if they enroll through an Affordable Care Act marketplace. The law reduced consumer premium costs to record lows and expanded eligibility for premium savings to middle-income individuals and families.

However, the American Rescue Plan is set to expire at the end of 2022, and existing consumers will see less federal financial help and higher costs when they receive their renewal notices in October if Congress does not act.

“At a time when many people are already facing increased economic pressures, some Californians may make the difficult choice of becoming uninsured in absence of the financial help that the American Rescue Plan provides,” Altman said. “Covered California stands ready to move mountains if Congress elects to extend the American Rescue Plan’s subsidies, but every single day matters. The longer we go without a decision, the harder it will be to avoid disruption and consumer confusion.”

A recent Covered California analysis, “Americans Brace for Higher Health Insurance Costs if the American Rescue Plan Is Allowed to Expire,” showed that an estimated 3 million Americans, including 220,000 Californians, could be priced out of coverage next year. In addition, the expiration of the American Rescue Plan would cause average net premiums to double for nearly 1 million low-income consumers, and middle-income Californians would no longer receive any federal financial help.

The uncertain future of the expanded American Rescue Plan subsidies added less than 1 percentage point to premiums, as carriers anticipated that healthy enrollees may choose to drop their coverage. Without this, consumers would be seeing a rate change of closer to 5 percent, which would be in line with what Covered California saw in its initial years.

“As we look at the change in underlying premiums this year, it is important to remember that what most Covered California consumers actually pay for coverage each month is based largely on the financial help available to them,” Altman said. “The biggest factor impacting what our consumers will pay for coverage in 2023 is whether Congress extends the enhanced subsidies, or not.”

On Tuesday, Covered California and 18 other marketplaces wrote to congressional leaders, highlighting the potential ramifications if the law is allowed to expire.

Covered California also noted that if Congress allows the American Rescue Plan subsidies to expire, the state of California stands ready to step in and mitigate some of the impacts. In the most recent state budget, California allocated $304 million to a state subsidy program, which would benefit both low- and middle-income consumers. While the funding is significant, and would help make health insurance more affordable for Californians, the federal subsidies under the American Rescue Plan amount to about $1.7 billion per year.

Covered California Adds Competition

Covered California’s high enrollment and healthy consumers continue to attract health insurance carriers, which has meant increased competition and choice. Changes to this year’s carriers include:

- Aetna CVS Health, which currently serves 34 million people across the nation, will join Covered California and begin offering coverage in El Dorado, Fresno, Kings, Madera, Placer, Sacramento, and Yolo counties.

- Anthem Blue Cross will return to San Diego County and will join Blue Shield of California as the second carrier to offer statewide coverage.

- Blue Shield of California will expand its Trio HMO plan into portions of Monterey County.

- Health Net will be ending its EPO plan product. Nearly 600 consumers spread throughout Contra Costa, Marin, Merced, Napa, San Francisco, San Joaquin, San Mateo, Santa Cruz, Solano, Sonoma, Stanislaus, and Tulare counties will be given the opportunity to choose a new plan or be moved to the carrier with the lowest-cost plan in the same metal tier.

As a result, with 13 carriers providing coverage across the state in 2023, all Californians will have two or more choices, 93 percent will be able to choose from three carriers or more, and 81 percent of Californians will have four or more choices.

“Covered California’s marketplace requires carriers to compete on price and quality, which increases affordability and allows Californians to choose the option that best fits their needs,” Altman said. “This year brings increased competition, and every Californian will have at least two carriers to choose from, with most having four or five choices.”

Covered California’s Special-Enrollment Period

While the rates and increased choice will not go into effect until coverage begins on Jan. 1, 2023, there are many life changes that allow Californians to enroll right now. The most common qualifying life events are losing health coverage, getting married, having a baby, permanently moving to California, or moving within the state where new carriers are offered.

In addition, there are several qualifying life events that are available due to the public health emergency and the American Rescue Plan:

- You or a family member have been affected by the COVID-19 pandemic.

- You have a household income under 150 percent of the federal poverty level, which is less than $19,320 for an individual and $39,750 for a family of four.

- Eligible consumers in this income bracket can find Silver 94 plans, the most generous coverage available through Covered California, with no monthly premium.

- You paid the penalty because you did not have health insurance.

A full list of qualifying life events can be found at this link.

“Californians can still benefit from the American Rescue Plan for the rest of the year if they need health insurance right now,” Altman said. “Right now, two of every three Covered California enrollees can get name-brand coverage for $10 a month or less, thanks to the expanded eligibility and record financial help through the American Rescue Plan.”

Consumers who sign up during special enrollment will have their coverage begin on the first of the following month.

Consumers Can Easily Check Their Eligibility and Options on CoveredCA.com

Consumers can explore their options in a number of different ways, including:

- Covered California’s online Shop and Compare Tool will show consumers if they are eligible for financial help and which plans are available in their area.

- Find the nearest certified enroller in your neighborhood by visiting https://www.coveredca.com/support/contact-us/.

- Call Covered California at (800) 300-1506 to get information or enroll by phone.

Covered California’s online enrollment portal and certified enrollers will also help people find out whether they are eligible for Medi-Cal. Medi-Cal enrollment is available year-round, and the coverage will begin the day after a person signs up.

Table 2: Covered California Individual Market Rate Changes by Rating Region

Statewide Total

Total enrollment2: 1,710,280

Avg. rate change: 6.0%

Shop and switch3: -5.8%

Region 1 – Alpine, Amador, Butte, Calaveras, Colusa, Del Norte, Glenn, Humboldt, Lake, Lassen, Mendocino, Modoc, Nevada, Plumas, Shasta, Sierra, Siskiyou, Sutter, Tehama, Trinity, Tuolumne and Yuba counties

Total Enrollment: 61,360

Avg. rate change: 11.3%

Shop and switch: 6.7%

Region 2 – Marin, Napa, Solano, and Sonoma counties

Total Enrollment: 59,780

Avg. rate change: 5.2%

Shop and switch: -1.0%

Region 3 – Sacramento, Placer, El Dorado and Yolo counties

Total Enrollment: 99,660

Avg. rate change: 4.7%

Shop and switch: -2.9%

Region 4 – San Francisco County

Total Enrollment: 36,190

Avg. rate change: 6.2%

Shop and switch: -3.2%

Region 5 – Contra Costa County

Total Enrollment: 55,220

Avg. rate change: 6.1%

Shop and switch: 0.1%

Region 6 – Alameda County

Total Enrollment: 78,950

Avg. rate change: 5.7%

Shop and switch: 1.2%

Region 7 – Santa Clara County

Total Enrollment: 66,750

Avg. rate change: 4.7%

Shop and switch: -3.3%

Region 8 – San Mateo County

Total Enrollment: 28,850

Avg. rate change: 6.0%

Shop and switch: -1.3%

Region 9 – Monterey, San Benito and Santa Cruz counties

Total Enrollment: 29,760

Avg. rate change: 5.5%

Shop and switch: -13.2%

Region 10 – San Joaquin, Stanislaus, Merced, Mariposa and Tulare counties

Total Enrollment: 82,940

Avg. rate change: 5.6%

Shop and switch: -3.8%

Region 11 – Fresno, Kings, and Madera counties

Total Enrollment: 42,400

Avg. rate change: 0.0%

Shop and switch: -4.8%

Region 12 – San Luis Obispo, Santa Barbara and Ventura counties

Total Enrollment: 78,190

Avg. rate change: 5.1%

Shop and switch: -1.6%

Region 13 – Mono, Inyo and Imperial counties

Total Enrollment: 16,530

Avg. rate change: 11.7%

Shop and switch: 8.3%

Region 14 – Kern County

Total Enrollment: 23,440

Avg. rate change: 2.7%

Shop and switch: -2.3%

Region 15 – Los Angeles County (northeast)

Total Enrollment: 224,400

Avg. rate change: 5.9%

Shop and switch: -10.5%

Region 16 – Los Angeles County (southwest)

Total Enrollment: 274,630

Avg. rate change: 6.8%

Shop and switch: -11.9%

Region 17 – San Bernardino and Riverside counties

Total Enrollment: 162,910

Avg. rate change: 6.7%

Shop and switch: -5.1%

Region 18 – Orange County

Total Enrollment: 159,640

Avg. rate change: 7.1%

Shop and switch: -8.5%

Region 19 – San Diego County

Total Enrollment: 128,700

Avg. rate change: 5.3%

Shop and switch: -7.7%

Table 3:California Individual Market Rate Changes by Carrier4

Anthem Blue Cross – 5.8%

Blue Shield of California – 9.2%

Bright Healthcare – 5.0%

Chinese Community Health Plan – 3.3%

Health Net – 2.9%

Kaiser Permanente – 4.0%

LA Care Health Plan – 2.1%

Molina Healthcare – 10.7%

Oscar Health Plan of California – 13.2%

Sharp Health Plan – 6.5%

Valley Health Plan – 6.5%

Western Health Advantage – 2.2%

Overall – 6.0%

About Covered California

Covered California is the state’s health insurance marketplace, where Californians can find affordable, high-quality insurance from top insurance companies. Covered California is the only place where individuals who qualify can get financial assistance on a sliding scale to reduce premium costs. Consumers can then compare health insurance plans and choose the plan that works best for their health needs and budget. Depending on their income, some consumers may qualify for the low-cost or no-cost Medi-Cal program.

Covered California is an independent part of the state government whose job is to make the health insurance marketplace work for California’s consumers. It is overseen by a five-member board appointed by the governor and the Legislature. “

For more information about Covered California or question about your health insurance for individuals, families and small businesses”, please visit www.solidhealthinsurance.com

_____________________________

1 The premium changes reported are based on the total premium, while many consumers pay only a portion of the total premium due to the federal and state subsidies that lower their costs. In some cases, consumers may receive relatively lower subsidies in the coming year so their out-of-pocket premium expenses may be different from the “average change” in premium.

2 Effectuated enrollment for coverage in the month of March 2022. See the full data profile.

3 Shop and switch refers to the average rate change a consumer could see if they shop around and switch to the lowest-cost plan in their current metal tier.

4 The weighted average rate change refers to the overall average throughout the state. Actual rate changes for consumers may vary based on their personal circumstances, the area they live in, and their plan’s metal tier.