Covered California released on July 19th, 2019 the regional rate changes for the individual and family (IFP) health insurance market for 2020. Unlike in the last few years where we saw rate increases of 8-12 percent, for 2020, we are seeing a statewide weighted average premium increase of 0.8%, the lowest rate change since Covered California’s launch in 2014.

For most Californians, there will be little to no changes to their health insurance premium. Some insured members may even see their premiums drops. This is due to the fact that the mandate to carry health insurance in California will be reintroduced in 2020. With an estimated bigger insurance pool Covered California has a better negotiation power to keep the health insurance rate flat. Furthermore, the Affordable Care Act mandates that 85% of health insurance premiums go towards medical costs. With healthcare costs beginning to flatten, so too are health insurance rates. This is fantastic news and a relief for many Californians.

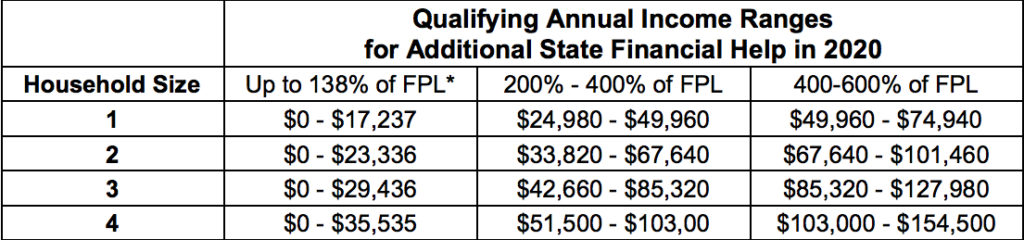

To help middle-income earners in Californians to buy health insurance in 2020, subsidies for health insurance premiums or premium tax credits are expanding from 400% of the Federal Poverty Level in 2019 to 600% in 2020 due to SB 78. Below is a chart illustrating that an individual making as much as $74,940 in adjusted gross income in 2020 or a family of four making as much as $154,500 may be eligible for subsidies or premium tax credits in 2020 to assist with their monthly premium. “Covered California projects that 922,000 people will be eligible for a new subsidy program that lowers the cost of their coverage, including 235,000 middle-income Californians who previously received no federal help”.

Below are some of the most populated regions rate increases for 2020.

Mid-to-West LA – 0.1% increase

- Oscar’s average plan rate change is a 5.9% decrease!

Mid-to-East LA – 2.6% increase

SLO, Santa Barbara & Ventura counties – 0.8% increase

San Francisco – 6.6% increase (region with highest increase)

- CCHP is seeing a major increase of 19.7%

Orange County – 1.0% increase

- Health Net Community Care HMO dropping by 5.8%

San Diego – 0.2% increase

- SHARP premiums are dropping 5.2-8.3% for HMO II & HMO I respectively

For a full list of the regional rate changes, please go to: https://www.coveredca.com/pdfs/CoveredCA_2020_Plans_and_Rates.pdf

Although the regional rate changes have now published for 2020’s individual market, we do not yet have the rates published for each specific plan from each carrier. The specific plan rates will be published by October, when the re-enrollment period begins and at the latest at the Open Enrollment Period which begins November 1st, 2019. During the Open Enrollment Period, you may change your health insurance plan without a qualifying life event for an effective date as early as January 1st, 2020.

Only during the Open Enrollment Period, you will be able to switch from an off-exchange health plan (a plan directly bought with the individual insurance carrier) to a health plan at Covered California (on-exchange health plan).

Furthermore, we are excited to announce the reintroduction of Anthem Blue Cross into Los Angeles, the Central Coast and Central Valley for 2020. For Los Angeles, Anthem BC will be offering their HMO product line but not their PPO plans.

At Solid Health Insurance Services, we are always here to keep our clients informed about the latest trends to the health insurance marketplace. Please contact us at 310-909-6135 or at info@solidhealthinsurance.com to go over your health, dental, vision, life and long-term care insurance needs. We are always happy to assist you to find the right plan for both your budget and medical needs.