Have you lost your job in the wake of the coronavirus? Unfortunately, millions of Californians and Americans have experienced the same situation with the nation’s unemployment reaching 14.7% as of April 2020 by the US Bureau of Labor Statistics. In California economic advisor predicting a possible June employment rate in 2020 of 20% and higher, along with many bankruptcy filings. So, now what? First and foremost, make sure to file for unemployment with California’s Employment Development Department or EDD at https://edd.ca.gov/unemployment/Filing_a_Claim.htm immediately, the longer you wait, the longer it will take to receive unemployment benefits. Once you have filed for unemployment, the next step is to review your insurance benefits and review if you will continue on your group’s insurance through COBRA or switch to an individual plan.

What is COBRA?

COBRA is short for Consolidated Omnibus Budget Reconciliation Act which gives terminated employees the right to continue their group health insurance without employer contribution. Those who decide to elect COBRA must also pay COBRA administrative fees ranging from 2% for Federal COBRA (groups with 20 or more employees) to 10% for Cal-COBRA (under 20 employees). If you really liked your group health insurance and do not mind paying full the full premium, meaning the employer and employee portion plus administrative fees, you may want to consider electing COBRA. Quite often the individual health insurance options are lower priced than the COBRA option, however, the networks are slightly smaller.

Do I have to elect COBRA?

No. You also have the option to elect individual health insurance but you must apply within 60 days of losing your group health insurance or wait until the Open Enrollment Period to elect individual health insurance for a January 1st effective date. During the Special Enrollment Period, you must have a qualifying life event such as loss of employer-sponsored coverage to be eligible to apply for health insurance. However, during this coronavirus pandemic, California and 10 other states are allowing the uninsured to be eligible to apply for health insurance through June 30th, 2020.

Options other than COBRA – Covered California versus Private Individual Insurance (Off-Exchange) or your spouse group health Insurance plan

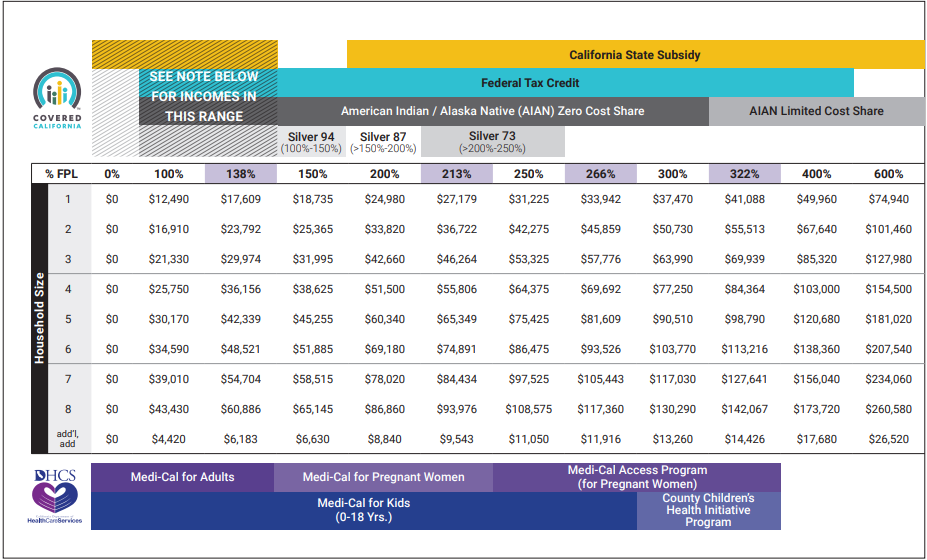

If your income, including unemployment income, is estimated to be above 138% of the Federal Poverty Level and below 600% of the Federal Poverty Level, you may be eligible for premium assistance through Covered CA. Income limits are based on your adjusted gross income for subsidy eligibility. Please see below the Federal Poverty Level Chart (FPL) to review if your estimated AGI for 2020 would put you within the limits for premium assistance in California. Covered California bases the subsidy calculation on your annual income. So you need to add your year-to-date salary income of your family, your regular unemployment benefits an additional $600 in weekly federal unemployment benefits through the Federal Pandemic Unemployment Compensation or FPUC which is suppose to end by July 31st, plus any investment or foreign income. Please contact your tax advisor for more in-depth calculation of the Adjusted Gross Income. Please note if your spouse is on a group health insurance you are most likely not be eligible to receive subsidies over Covered California.

If your income is still above the chart limits above, you will not qualify for premium assistance through Covered CA. Instead, you should be reviewing the rates of the private insurance carriers (Off-exchange) such as Blue Shield, Anthem, Kaiser, Oscar and Health Net off available in your region and compare the plan benefits and premiums to the COBRA benefits offered by your COBRA administrator and if applicable your spouse dependent group health insurance plan.

Spouse group health insurance plan

You may also compare the cost to add yourself as a dependent on your spouse group health insurance plan. We see often that the individual insurance rates of the private insurance carriers such as Blue Shield, Oscar, Health Net, Kaiser are more competitively priced than the group dependent rates. Please note if your spouse has a group health insurance you will be most likely not eligible to receive subsidies with Covered California.

To learn more about your insurance options after losing your employer-sponsored benefits, please contact us and we can go over all of the options available to you. Please contact us at info@solidhealthinsurance.com or at 310-909-6135. At Solid Health Insurance Services, we strive to assist our clients in finding the right health, dental, vision, life, and long-term care that meets both your budget and medical needs.