With a 50% likelihood of a 65-year-old reaching the age of 93, many of us can expect to live nearly a third of our lives in retirement. Having a long and fruitful life can be an adventure full of new experiences and life lessons.

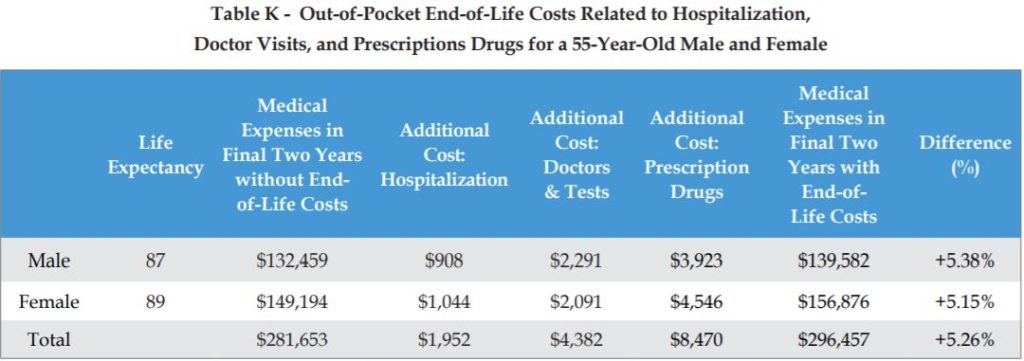

One major lesson is to make sure your retirement plan factors in the rising healthcare costs and Medicare premiums that come with age. A very informative 2017 study from HealthView Services suggests that a couple in their mid-60’s expecting to live to the ages of 87 and 89, respectively, can expect to pay a combined $321,994 in premiums for Medicare Part B & D, supplemental and dental insurance over their life expectancy with estimated out-of-pocket expenses of $82,258 for a total of $404,252 in today’s dollars or $607,662 in future dollars (2017 Retirement Health Care Costs Data Report “HealthView Services”).

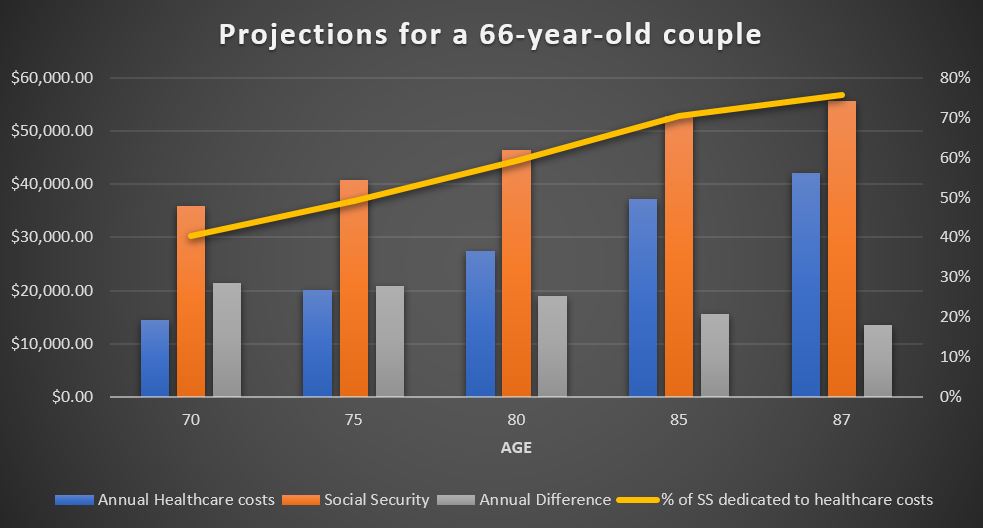

The cost of healthcare is estimated to rise 5.6% annually while Social Security’s Cost of Living Adjustment or COLA is only a 2.8% annual increase to Social Security income as of 2019, only accounting for half of the annual healthcare cost increases. With that in mind, more and more of your Social Security income will go towards Medicare premiums and out-of-pocket expenses with age, increasing from 40% of Social Security income going towards healthcare costs at age 70 to up to 76% by age 87.

So, what measures should you incorporate into your retirement plan to protect your finances from the rising healthcare costs? First and foremost, do your best to stay physically and mentally healthy by eating healthy, exercising regularly, being involved in your community and keeping up with loved ones. Having a community to support you through the ups and downs will be instrumental to a successful retirement last.

Plan ahead, especially in the last two years of life, retirees will want to plan for additional out-of-pocket expenses. A long-term care insurance policy will help to offset these costs by covering nursing care, assisted living, adult daycare, hospice care and other services . More recently, long-term care insurance has been combined with life insurance as a rider embedded in a whole or universal life insurance.

Life insurance is another major consideration to include in your retirement planning. Whole and universal life can offer cash value accumulation tax-free which you can borrow against if needed through retirement. You can also provide your spouse a tax-free death benefit or even provide yourself an accelerated death benefit during your life time in case of a terminal illness or long-term care needs. Long-term care insurance can be purchased separately or as a rider onto a whole or universal life insurance policy. Annuities, a type of insurance for guaranteed, Social Security-like income, can be a great supplement to life and long-term care insurance to protect retirees from living past their retirement savings.

One of the less popular but still important retirement tips to consider is working through your retirement. Not only will working through retirement provide additional income to offset healthcare and other costs, but also contemplate the social aspects, rewards, and sense of worth created by working. Many early retirees complain of a lack of sense of efficacy, not being depended on for work and not having enough tasks to keep themselves busy.

Overall, by maintaining a healthy lifestyle and by taking control of your finances with a holistic approach, retirement should not be a worrisome time but a time of exploration, meditation, reflection and joy.

Solid Health Insurance Services wishes you a long and prosperous retirement. Please do not hesitate to contact us to go over your health, dental, vision, life and long-term care needs. You cannot afford to do nothing. Contact us at info@solidhealthinsurance.com or at 310-909-6135