Governor Newsom reintroduced the tax penalty for not carrying health insurance for 2020. California and a handful of other states have countered to the federal government with their own state-wide tax penalties to enforce the Affordable Care Act’s health insurance mandate. The health insurance mandate requires all U.S. citizens to have comprehensive health insurance that meets the 10 essential benefits mandated by the Affordable Care Act. California has finally stepped up to the table to introduce their own state tax penalty for not having health insurance which goes into force for the 2020 tax year. The new tax penalty will be $695 per person, $2,085 per family, or 2.5% of your individual/family’s gross income, whichever is higher.

New Jersey, Vermont, the District of Columbia, and now California will have the tax penalties in force to protect the risk pools of ACA-compliant health insurance plans. The new tax penalty appears to be helping reduce the annual rate increases for the individual and family health insurance market. In 2019, roughly half of the 8.7% weighted average increase was attributed to the tax penalty going away. In 2020, we are seeing a record low 0.8% weighted average premium increase across California thanks in part to the reintroduction of the tax penalty. California is proving it will protect the Affordable Care Act from attempts by the federal government to weaken it.

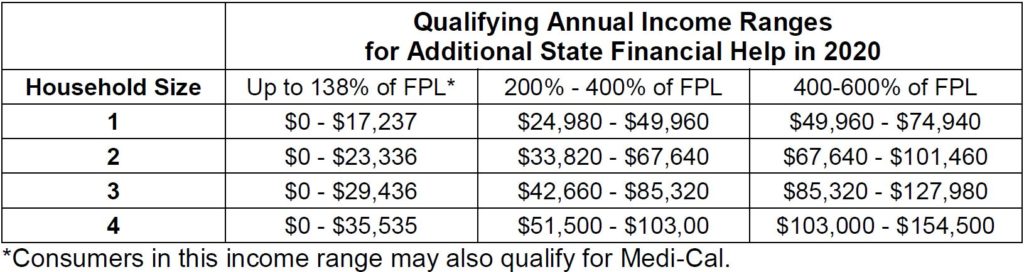

Furthermore, California will also expand the subsidy cutoff from 400% of the Federal Poverty Level in 2019 to 600% in 2020. An individual making just under $75,000 or a family of four making as much as $154,500 may be eligible for these new subsidies. If you are offered group health insurance from an employer, you are only eligible for individual subsidized health insurance if your group insurance does not meet the affordability test and your health insurance options are higher than 9.8% of your income.

The new state tax penalty in California will fund this subsidy expansion to those newly eligible in 2020. With more individuals and families receiving premium tax credits to assist with their health insurance premiums, we will likely see more stability in the health insurance market, especially for the individual/family marketplace.

At Solid Health Insurance Services, we are always here to keep our clients informed about the latest trends to the health insurance marketplace. Please contact us at 310-909-6135 or at info@solidhealthinsurance.com to go over your health, dental, vision, life, and long-term care insurance needs. We are always happy to assist you to find a suitable health plan for both your budget and medical needs.