Open enrollment for the Individual health insurance market for 2024 starts November 1st, and it’s time to start thinking about your healthcare coverage for the upcoming year. Policyholders have the opportunity to review their 2024 health insurance options. This is a crucial time for you to review your coverage due to the statewide premium increase of 9.6%. The increase was attributed not only to the persistent surge in healthcare utilization post-pandemic, but also to higher pharmacy expenses and inflationary impacts within the healthcare sector, such as escalating costs of care, labor shortages, and salary and wage raises. Policyholders can also update their personal information as well as their income. Your existing health plan will be renewed automatically if you make no changes unless stated otherwise. Key dates to remember: the enrollment period for 2024 runs from November 1 to January 15.

Covered California

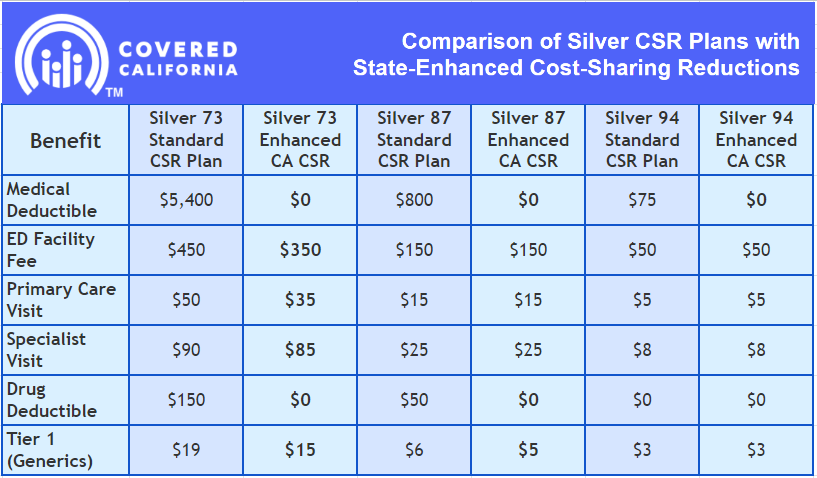

In 2024 Covered California offers Californians whose incomes are no more than 250% of the federal poverty level to be eligible for three silver plans that will require no deductible. These are household earnings of at least $33,975 for an individual and $69,375 for families of four. Read all the details in the full article here.

Here’s the Comparison of Silver CSR Plans with State-Enhanced Cost-Sharing Reductions

Moreover, in all three Silver CSR plans, deductibles will be entirely eliminated, thereby removing a potential financial obstacle when it comes to accessing healthcare and streamlining the process of selecting a plan. In addition, other benefits will vary by plan. Still, they will include a reduction in generic drug costs and copays for primary care, emergency care, and specialist visits, and a lowering of the maximum out-of-pocket cost.

Oscar Health

Oscar will no longer offer individual insurance in the California market. As a result, individuals who are policyholders with Oscar will need to transition to a different insurance carrier for their coverage. Furthermore, policyholders should diligently investigate alternative insurance options to secure continuous health coverage.

Blue Shield of California

Blue Shield serves more than 3.4 million members and has almost 65,000 physicians across the state. It offers HMO and PPO plans. The HMO Trio has a solid primary care doctor network with the Providence system (St. John Hospital, St. Joseph, Providence Cedars Tarzana, Access Medical Group Allied Pacific, UCLA, and Cedars are not in the network). The PPO coverage has an extensive network with self-access to many UCLA, Cedars Sinai, and Providence doctors. Premium costs, however, will increase to 15% in 2024.

Anthem Blue Cross

With over 8.6 million members in California alone, Anthem Blue Cross covers more Californians than any other carrier in the state. Anthem’s broad provider network includes over 65,000 care providers in California. Alongside the Providence System, Axminster, Allied IPA, and others—however, not UCLA and Cedars. Their premium rate increase in 2024 is 10.9%.

Health Net

In 2022, Health Net’s individual and family plans (IFP) will have a new name, Ambetter from Health Net. Available in most counties in California, they offer HMO, EPO, and PPO plans. Their PPO plans do not contract with UCLA or Cedars Sinai, but they allow self-referral to the Providence system and other providers. Premium costs will increase to 8.4% in 2024.

Kaiser Permanente

Kaiser serves more than 10 million members, offers HMO coverage with the Kaiser System, and includes access to Kaiser hospitals. They own the facilities, and they do hire doctors. Their premium rate increase in 2024 is 7.4%.

LA Care Covered

L.A. Care offers HMO plans with access to the UCLA system and, depending on your zip code, the Providence system, Optum, Prospect IPA, PIH, and more. Premium costs will increase to 6.1% in 2024.

Please read our blog to check out other provider options in California and their premium increase expectancy for 2024.

At Solid Health Insurance, we ease the complexity of the individual insurance market. We find a health plan that fits your budget and your medical needs, whether you’re considering renewing your current plan or shopping for a new one. It’s important to know that not having health insurance can lead to a tax penalty. Keep this in mind when you’re deciding on your healthcare coverage to avoid any extra costs.

You may call us at 310-909-6135 or book an appointment. We’d be happy to answer your questions about your health insurance so you can make well-informed decisions about whether it is your individual, family, or small business’s coverage.