by Barbara Kempen | Apr 11, 2023 | Affordable Health Insurance, Benefits Administration, Covered California, Health Insurance Brentwood, Health Insurance Pacific Palisades, Health Insurance Santa Monica, Special Enrollment Period, Tax Credits, Tax Penalty

As many Americans are still preparing their taxes before the April 18th deadline, please make sure that you have your 1095 (federal) tax form and provide them to your tax preparer as they are required to complete your taxes. In California, there is a tax penalty for...

by Barbara Kempen | May 4, 2022 | HSA

In 2023, there are major increases to the HSA or Health Savings Account contribution limits. An HSA or Health Savings Account is a tax-advantaged investment account that can be withdrawn from for qualified medical expenses tax-free. The funds you deposit into an HSA...

by Barbara Kempen | Apr 6, 2022 | Affordable Health Insurance, Tax Credits, Tax Penalty

As many Americans are still preparing their taxes before the April 18th deadline, please make sure that you have your 1095 (federal) & 3895 (state) tax forms and provide them to your tax preparer as they are required to complete your taxes. In California, there is...

by Barbara Kempen | Mar 11, 2022 | Tax Penalty

Since the federal government removed the tax penalty for not having health insurance in 2019, many Californians may think they are not subject to a tax penalty for not having health insurance. California responded to the removal of the federal penalty by establishing...

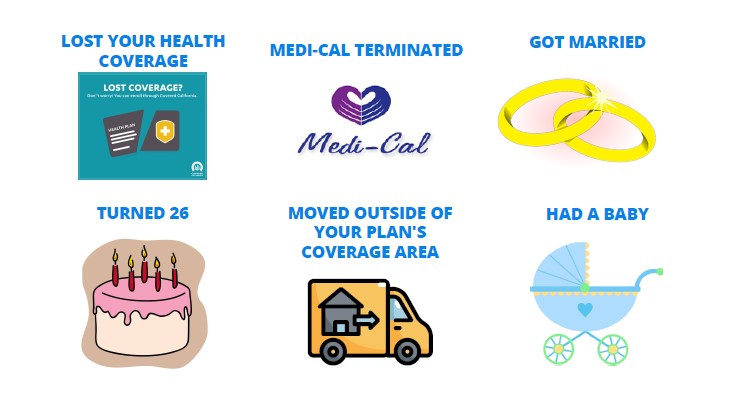

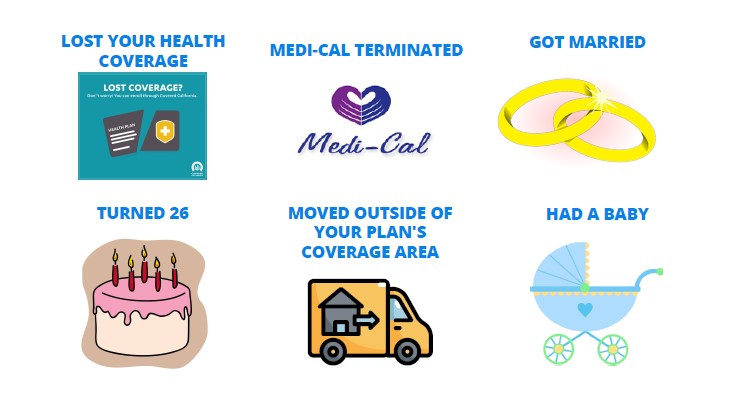

by Barbara Kempen | Mar 9, 2022 | Special Enrollment Period

Once the Special Enrollment Period started on February 1st, 2022, anyone looking to enroll in or change their health insurance must now have a qualifying life event to do so. A qualifying life event is a major life event that must occur within the last 60 days in...