As we move closer to 2026, Covered California has released its updated standard benefit designs for all health plan tiers. These designs outline the core structure of every plan offered through the marketplace, including deductibles, copays, coinsurance, and out-of-pocket maximums.

While premiums are projected to rise an average of 10.3% statewide, the bigger story lies in how benefit structures are shifting — particularly for the Silver 73 plan, which plays a crucial role for many California households.

The Return of Pre-Pandemic Silver 73 Benefits

In 2025, Silver 73 enrollees benefited from temporary pandemic-era enhancements and additional state funding that reduced deductibles to zero and lower out-of-pocket maximum. This relief made healthcare more affordable for many Californians, even those over the 600 % Federal Poverty Level (FPL).

However, beginning in 2026, Covered California will return the Silver 73 benefit design to its pre-pandemic structure. That means higher cost sharing:

- $5,200 deductible for individuals

- $10,400 deductible for families

- $8,100 out-of-pocket maximum $ 16200 family

In practice, this change will make the Silver 73 plan feel more like a standard Silver plan again, and less like the enhanced versions (Silver 87 and Silver 94). For families just above the income thresholds of 250 % Federal Poverty Level and middle-income earners, will be moved to the regular Silver 70 plan with a deductible of $ 5200 and an out-of-pocket maximum of $ 9100. This rollback will mean significantly more out-of-pocket exposure.

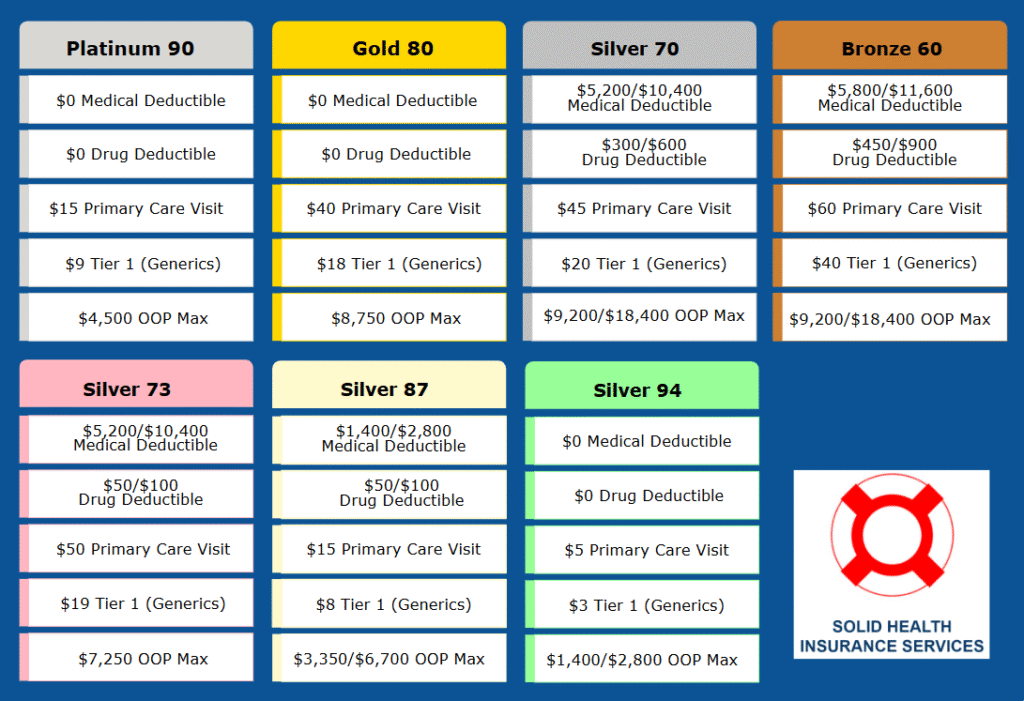

Comparing the 2026 Plan Tiers

Covered California organizes its offerings into metal tiers — Bronze, Silver, Gold, and Platinum — each designed to strike a different balance between monthly premiums and cost at the point of care. Here’s what the updated 2026 structure looks like:

Bronze 60 ( will be HSA eligible – new for 2026)

- Medical Deductible: $5,800 individual / $11,600 family

- Drug Deductible: $450 / $900

- Primary Care Visit: $60 ( limit 3 before deductibles )

- Generic Drugs: $40

- Out-of-Pocket Maximum: $9,800 indivdual/$ 19,600 family

Who it’s for: Consumers seeking the lowest premium, and who are comfortable paying most expenses out-of-pocket unless a major health event occurs. In 2026 they will be HSA eligible. Emergency rooms, MRI, and Ambulance are subject to the deductible.

You might want to consider buying a hospital indemnity plan, accident plan, or lump-sum plan to offset the high deductible.

Silver 70

- Medical Deductible: $5,200 individual / $11,600 family

- Drug Deductible: $300 / $600

- Primary Care Visit: $45

- Generic Drugs: $20

- OOP Max: $9,800individual /$19,600 family

You might want to consider buying a hospital indemnity plan, accident plan, or lump-sum plan to offset the high deductible.

Silver 73 (Enhanced, 200–250% FPL)

- Medical Deductible: $5,200 individual / $10,400 family

- Drug Deductible: $50 / $100

- Primary Care Visit: $50

- Generic Drugs: $19

- OOP Max: $8,100 – $ 16,200

Who it’s for: Households earning between 200% and 250% FPL. Offers some reduction in cost-sharing compared to standard Silver, but not as generous as Silver 87 or Silver 94.

Californians with an income exceeding 250% of the Federal Poverty Level will lose the Silver 73 plan and will be moved to a regular Silver 70 plan. Many middle-income earners will revert to the high deductible of the Silver 70 plan . You might want to consider buying a hospital indemnity plan, accident plan, or lump-sum plan.

Silver 87 (Enhanced, 150–200% FPL)

- Medical Deductible: $1,400 individual / $2,800 family

- Drug Deductible: $50 / $100

- Primary Care Visit: $15

- Generic Drugs: $8

- OOP Max: $3,350 individual / $ 6,700 family

Who it’s for: Lower-income households that qualify for richer benefits, making this one of the best values for eligible members.

Silver 94 (Enhanced, 100–150% FPL)

- Medical Deductible: $0

- Drug Deductible: $0

- Primary Care Visit: $5

- Generic Drugs: $3

- OOP Max: $1,400 individual /2800 family

Who it’s for: Very low-income households who qualify for the most generous Silver plan. Out-of-pocket costs are minimal compared to other tiers.

Gold 80

- Medical Deductible: $0

- Drug Deductible: $0

- Primary Care Visit: $40

- Generic Drugs: $18

- OOP Max: $8,750

Who it’s for: Consumers who prefer predictable costs with no deductible, though premiums are higher than Silver or Bronze.

Platinum 90

- Medical Deductible: $0

- Drug Deductible: $0

- Primary Care Visit: $15

- Generic Drugs: $9

- OOP Max: $4,500

Who it’s for: Individuals who frequently use healthcare services and seek the lowest possible costs for care. Premiums are the highest of all tiers, but cost sharing is minimal.

Why These Changes Matter

The return of the pre-pandemic Silver 73 design could be a financial shock for many middle-income families who saw their healthcare costs reduced during 2025. With deductibles once again in the thousands of dollars, budgeting for medical expenses will be essential. You might want to consider buying a hospital indemnity plan, accident plan, or lump-sum plan to offset the high deductible.

Coupled with an average 10.3% premium increase across the state in 2026, the overall affordability of health insurance will continue to be a challenge — especially if federal enhanced subsidies expire.

Tips for Consumers

- Check Your Income Eligibility: If you’re close to the 200% FPL threshold, even a small change in income could qualify you for the more generous Silver 87 or Silver 94 plans.

- Balance Premiums vs. Deductibles: Although lower premiums may seem appealing, higher deductibles can quickly add up if you require regular care.

- Consider buying a hospital indemnity plan, accident plan, or lump-sum plan to offset the high deductible.

- Consider Gold or Platinum Plans: If you expect higher healthcare use, the no-deductible plans may provide better overall value despite higher premiums.

- Review Networks and Providers: Not all carriers cover the same hospitals and doctors. Always confirm your preferred providers are included.

- Don’t Wait Until the Deadline: Open Enrollment begins November 1st, and plan auto-renewals start in the middle of November. Take time to review and adjust before it’s too late.

Final Thoughts

The Covered California marketplace remains one of the strongest state exchanges in the country, but benefit structures are evolving. With premiums increasing and the Silver 73 rollback, reviewing your plan during Open Enrollment will be more important than ever. If you’re considering an upcoming procedure at an outpatient surgery center or hospital, schedule it for 2025 to take advantage of the 0 deductible out-of-pocket maximum of $ 6200; these great benefits will not be available in 2026.

Solid Health Insurance Agency is here to guide you through these changes, provide side-by-side comparisons, and ensure that your 2026 health coverage fits both your medical needs and your budget.